Entity Status in Patent Applications

- June 18, 2019

- Posted by: Kamila Williams

- Category: Blog

When a patent application is filed, as well as during prosecution, the type of entity which the applicant claims determines government fees to be paid. Applicant must determine whether they are large, small or micro.

Large Entity

The Large Entity status is when the USPTO fees are paid at the standard rate (see current fee schedule at the following link USPTO Fee Schedule). Everyone who does not qualify for a small or micro is automatically a large entity. Additionally, change to a large entity can happen during the prosecution, for example, if an Applicant has asserted a small entity at the time of filing, but the company grew or merged with other larger companies. In that instance, a large entity must be claimed by filing an Assertion of Large Entity either by submitting a general letter form or via web-based Assertion form. It is required that this is done at the time of Issue fee payment and thus the successor Applicants can benefit from small entity status throughout the prosecution regardless of change in assignment/applicant until then.

Small Entity

Small-entity applicants are mostly non-profit organizations, small businesses and individuals (although individual inventors may qualify for a micro entity – see next section). Other qualifying criteria for a small entity is the business’ size. If a business, with all its affiliates, has less than 500 employees, and has not assigned or licensed the present patent application to an entity that is a large-entity organization, the business can also qualify for a small entity.

Micro Entity

In 2013, the USPTO created a new entity status category called micro entity, which allows the inventor (applicant) to further reduce some of their USPTO fees by an additional 25% compared to small entity fees. To qualify for a micro-entity status, the applicant must already be a small-entity. There are additional ways to qualify for a micro-entity status.

- The first criteria are that the inventor, applicant or joint inventors have not been listed as an inventor on more than four (4) prior patent applications, excluding provisional, foreign, international application (not filed in US receiving office), and application assigned by inventor’s previous employment.

- The second criteria are an annual gross income. Currently the annual gross income limit for micro entity is $184,116. (see the following link for recent minimum-salary requirements Minimum Salary Requirement for Micro-Entity Status.)

- Further, the inventor (applicant) must not have assigned, licensed or otherwise granted rights for the invention to an entity who has gross income more than the amount listed above (unless the entity relates to an institution of higher education).

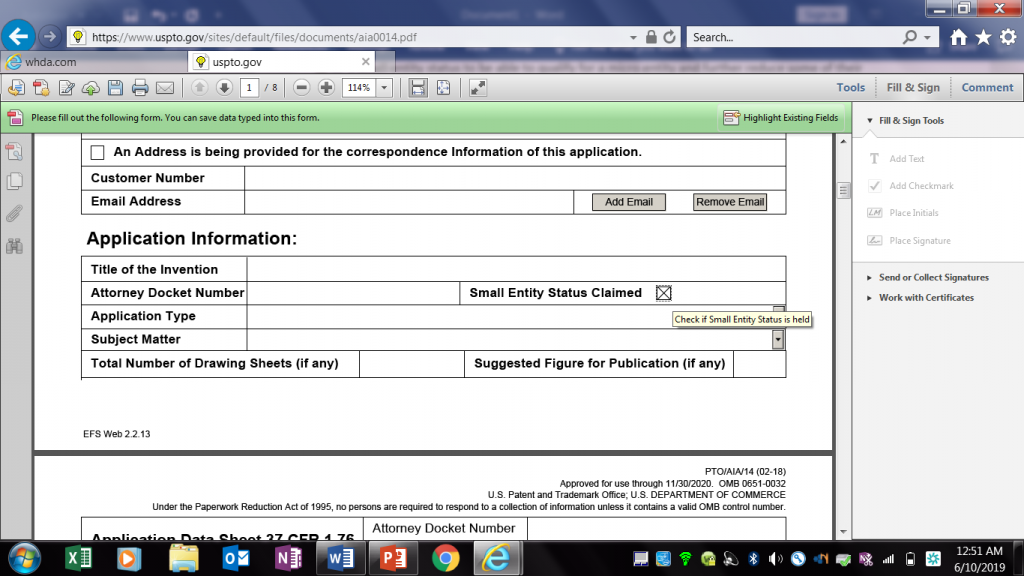

How to claim small entity status

A small entity is established and accepted by the USPTO by checking a simple box on the first page of the Application Data Sheet (ADS) (see below). If an application has already been filed, and small entity had been discovered, an “Assertion of Small Entity” letter to Examiner should be filed. This can also be done electronically via EFS web-based submission.

How to Claim Micro Entity Status

For micro entity, a certification of micro-entity status must be filed with or before any payment of fees at the micro-entity rate. If the micro entity was not applied for at the time of initial filing, the USPTO fees will not be refunded retrospectively.

To apply for micro-entity status on gross income basis, a form SB/15A must be submitted. To apply for micro-entity status on higher education basis, a form SB/15B must be submitted.

A Few Reminders

If a micro-entity status no longer applies, the inventor (applicant) must file a loss of entitlement for micro entity. The USPTO does not accept paying the higher fees ONLY.

It is also important to remember that a separate micro-entity certificate is required in each newly-filed application, even if the new application is a continuation/divisional of the same family.

When an entity claim is filed in error, but in good faith, the mistake will be excused by USPTO, so long as the difference is paid together with a paper formally explaining the situation.